Audit Service for SMEs

Why do Hong Kong limited companies need audit?

From a legal perspective: According to Chapter 622 of the Companies Ordinance, Hong Kong limited companies are required to engage a practicing accountant to conduct an annual audit and submit the audited report, signed by the practicing accountant, to the Hong Kong Inland Revenue Department.

From a company's operational perspective: The purpose of audit and accounting is to assess the reliability of a company's financial condition, financial records, and financial-related information, culminating in the issuance of an audit report. The audit report serves not only for tax computation by the Inland Revenue Department but also as a validation of the legitimacy of the company's commercial activities.

City AI Accounting has a team of experienced accountants,

who can provide you with professional auditing service.

Tax Worries? No Problem!

- Profit and Loss Account for the financial year

- Balance Sheet as the last date of the financial year

- Reports written by certified public accountants and independent opinions

- Tax computation

- Form filling of tax return

- Tax Planning

- Director's report

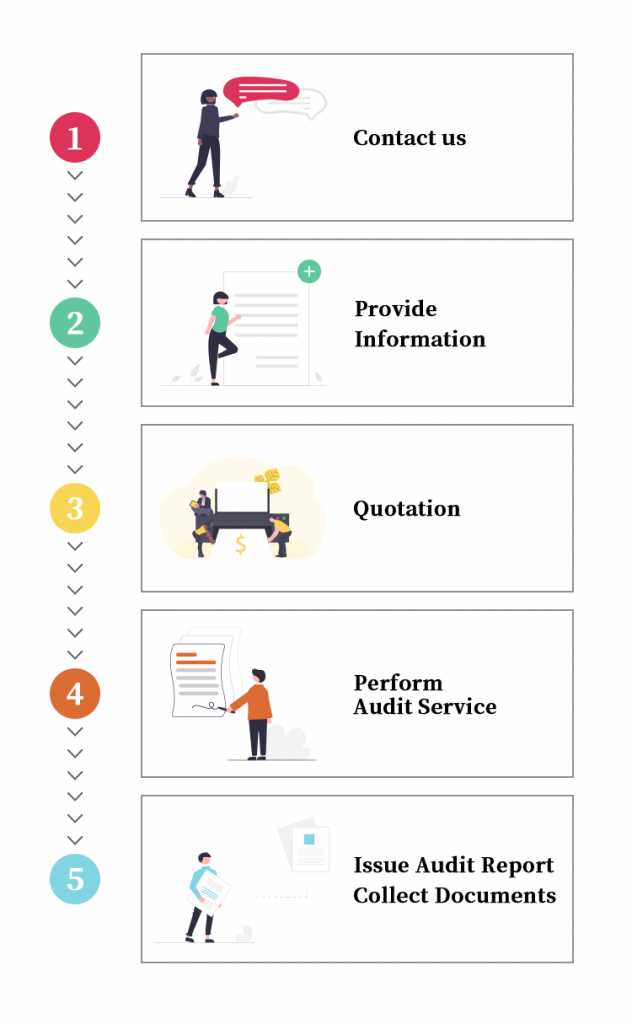

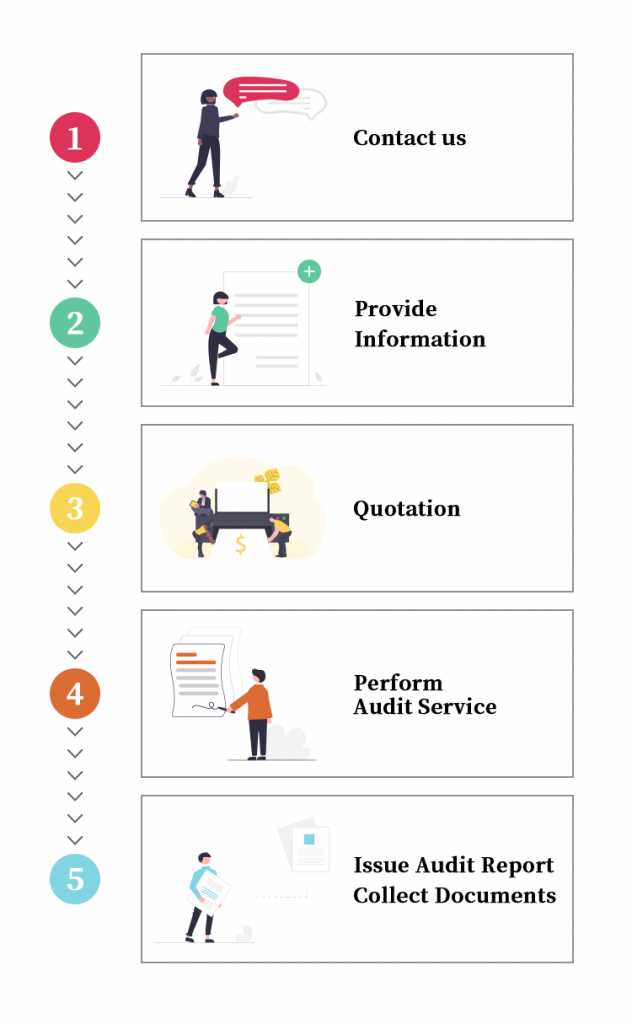

Audit Service Process

City AI Accounting Partner Team

Q&A

Companies in Hong Kong are only required to pay profits tax every year. The tax rate for the first HK$2 million of the corporation is 8.25%, and the subsequent profits are taxed at 16.5%; for those sole proprietorships or partnership business, the two-tier profits tax rate is 7.5% and 15% respectively. If the company has no profit, it is not required to pay profits tax.

You need to provide the following documents for audit work: Profit and loss statement, balance sheet, trial balance, MPF contribution statement, salary statement, salaries tax return, statement of accounts, general ledger, bank statement, sales, purchases and Expenditure receipts, contracts and agreements, loan information, related company information, asset purchase and sale documents, tax office documents, company secretary documents, copies of ID cards and proof of address, audit reports and tax forms for the previous year… etc. Of course, if you use the service of City AI Accounting, all those above will be organized and provided by us.

The work of audit is the process of systematically reviewing, evaluating and reconciling a company’s financial records and financial-related information. The purpose is to assess the reliability of a company’s financial position, financial records and financial related information, and to issue an audit report. The audit report is used by the Inland Revenue Department for tax calculation purposes and also provides evidence of the legitimacy of the company’s business activities.